Author: Davit Shatakishvili, Contributing Analyst, American University, Washington D.C.

Recep Tayyip Erdogan presented a new economic team for the government following his victory in Turkey’s presidential elections last May. Mehmet Şimşek was appointed Minister of Treasury and Finance, while Hafize Gaye Erkan took on the position of head of the Central Bank. This change signaled Turkey’s shift from Erdogan’s unconventional macroeconomic approach to a more traditional economic model. The main reason for the changes was the record-breaking devalued national currency and the skyrocketing inflation.

The new economic team implemented several hikes in the monetary policy rate, ultimately raising it to 45%, yet inflation remained uncontrolled even after nine months. In February, Hafize Gaye Erkan resigned, attributing her decision to a slander campaign. Her deputy, Fatih Karahan, was appointed as her successor, becoming the sixth individual to lead the Central Bank in the past five years.

The ongoing economic crisis in Turkey, marked by escalating inflation and a weakening currency, is particularly noteworthy in light of the municipal elections scheduled for the end of March. These economic challenges, notably under President Erdogan’s tenure, could significantly influence the political climate and voter decisions, making the economic forecasts for the current year a critical factor in the upcoming elections.

Decisions Made by the Newly Formed Economic Team

Since May 2023, with Hafize Gaye Erkan at the helm, the Central Bank of Turkey has raised its monetary policy rate on eight occasions, amounting to a total increase of 3,650 basis points. The most recent adjustment occurred on January 25, when the refinancing rate was boosted by an additional 250 basis points, reaching 45%. Furthermore, certain banking regulations were relaxed, and efforts were initiated to develop mechanisms aimed at shielding lira-denominated deposits from devaluation. Additionally, the Central Bank has indicated its readiness to encourage the repatriation of foreign currency that exited the banking system due to the national currency crisis. This move signifies an effort to stabilize and enhance the financial situation by attracting foreign currency back into the country’s banks. The primary objectives of this strategy are to bolster the strength of the national currency and to replenish foreign exchange reserves.

On February 3 of this year, Erkan resigned, and her deputy, Fatih Karahan, took her place. In response to this change, the country’s Finance Minister publicly expressed full confidence and support for the new Central Bank president from the government’s economic team. Moreover, the Minister highlighted that Fatih Karahan trusts and supports the economic program currently being executed by the government.

Karahan emphasized that his primary focus will be on achieving price stability, and said he intends to persist with these efforts alongside a robust team to promote disinflation. This approach indicates a continuation of the tight monetary policy until there is a significant reduction in inflation pace. He also stated that the Central Bank closely monitors inflation expectations and price dynamics, positioning them to respond promptly in the event of any adverse scenarios.

Inflation and the National Currency

Since 2018, the Turkish lira has been undergoing devaluation, with its rate of depreciation particularly intensifying following the global pandemic. To combat the national currency’s devaluation and soaring inflation, Turkish President Recep Tayyip Erdogan opted for an unconventional economic policy. Contrary to the global trend of tightening monetary policy, he reduced the refinancing rate. This decision resulted in further depreciation of the lira and a rapid increase in inflation. This, obviously, caused great dissatisfaction among the population, which put Erdogan in a disadvantageous position before the 2023 elections. Yet he also found it politically inadvisable to pursue a traditional monetary policy to deal with inflation, as it would slow the economy and increase the risks of recession. Therefore, the Central Bank decided to keep the monetary policy rate unchanged at 8.5%. It also undertook the responsibility of safeguarding the lira by utilizing foreign exchange reserves. The Central Bank aimed to stabilize the national currency by purchasing lira in the international currency market, with the objective of setting the value of 1 US dollar to 20 lira. While effective in the short term, this strategy was quite costly, with the Central Bank spending approximately 8 billion USD on these efforts.

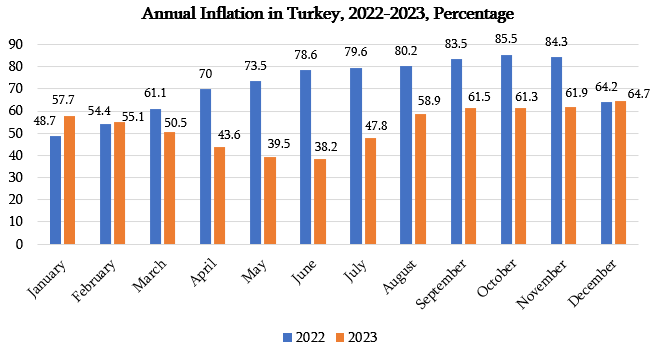

In January, annual inflation amounted to 64.9%. In the recent period, the highest inflation in Turkey was recorded in October 2022, exceeding 85%, the highest the country has seen in the last 24 years. The data from the graph indicates that, in 2023, there was a relative decrease in the rate of price growth compared to the previous year, although it still remained at a high level. Despite the implementation of a tighter monetary policy since the May 2023 elections, inflation continued its upward trend, reaching a peak in December 2023, when prices rose by an average of 64.7%.

Source: Turkish Statistical Institute

The Central Bank of Turkey anticipates that inflation will not begin to decrease until the second half of this year. By the end of 2024, they expect inflation to drop to 36%, which is still significantly high, being 7 times above the target rate of 5%. In contrast, the forecast from the World Monetary Fund is more pessimistic, projecting that inflation in Turkey will decrease to 46% by the end of 2024.

This year, the Turkish lira hit a new low, with the exchange rate exceeding 30.5 Turkish lira for one US dollar. The graph illustrates that over the past two years, the lira has experienced particularly significant devaluation, setting new lows each month. A key factor driving the devaluation of the national currency is the relentless inflation and the worsening sentiment among investors towards the country.

Source: Central Bank of the Republic of Turkey

Why Can’t the Inflation be Curbed?

Adopting a traditional economic model in Turkey sparked expectations of mitigating inflation and bolstering the national currency. Yet, the Central Bank’s actions in this context have attracted criticism. Under the new leadership, the monetary policy rate was initially raised from 8.5% to 15%, a figure considered substantially high compared to European standards. However, according to some experts, in the conditions of about 55% inflation, the 15% refinancing rate is not enough. It is the late decisions of the Central Bank that explain the fact that it was not possible to control inflation in the last 9 months. When the monetary policy rate is increased, it takes some time for its effect to be reflected in the economy. However, in the case of Turkey, neither was time found to be a sufficient factor to restrain inflation, nor the pace and tendency of the monetary policy rate increase, which some experts consider to have come rather late. This suggests that stricter and more radical decisions from the Central Bank at the initial stage could have been more effective.

According to some economists, another factor stimulating inflation is the Turkish government’s decision to raise the minimum wage. In December 2023, the amount of the minimum monthly salary increased to 17,002 liras, which is almost 27% more than in July of the same year.

Clearly, this situation presents a dual challenge. On one hand, the elevated minimum wage rate increases production costs for the business sector, leading to higher prices for products and services. On the other, rising wages enhance purchasing power, thereby boosting demand. This increase in demand is a significant factor contributing to inflation. In this regard, it is also necessary to take into account the existing inflationary expectations of economic agents, which is an important component of the increase in the overall level of prices.

Effective management of inflation depends on the country’s fiscal policy and the handling of government expenditures. President Erdoğan is notably recognized for implementing subsidies, particularly during pre-election periods. Such practices lead to an increased amount of money in circulation among the population, thereby elevating demand. This surge in demand is another factor contributing to inflation. Moreover, the worsening sentiment of investors towards the country plays a crucial role. Investor decisions, often influenced by market expectations, can be a significant source of inflation. The continual devaluation of the national currency is particularly impactful in this context, leading to increased import costs, which subsequently make products or services more expensive. This escalation in prices not only contributes to inflation but also diminishes the purchasing power of the population.

***

Nine months on from the Turkish presidential election in 2023, the new government economic team, which adopted a traditional macroeconomic policy approach under President Erdogan, has not only been unable to curb inflation, but is also facing an ongoing upward trend in inflation rates. Additionally, the sharp devaluation of the national currency has taken on an irreversible trend during this period. It is evident that recovering from three years of double-digit inflation and the record depreciation of the lira will require time.

Expectations for immediate outcomes from the tight monetary policy are somewhat over-optimistic. Consistent with predictions, the Central Bank of Turkey, even under the new leadership, is anticipated to maintain a high monetary policy rate throughout this year. However, the outlook on inflation is positive, with a decrease expected by year-end. Besides raising the refinancing rate, the Central Bank will need to implement a range of measures aimed at protecting the national currency, boosting foreign exchange reserves, and ensuring the stability of the banking sector. It remains to be seen how swiftly Turkey can emerge from its severe economic crisis, a recovery that holds significant importance not only for the region but also for the global economy.